Delta Airlines to Buy

an Oil Refinery???

A very puzzling possibility with no

apparent justification or benefit

|

|

Oil refineries are

unsightly and unprofitable. Why would an airline want

to saddle itself with another loss making venture? |

No, it isn't a late April Fools

Day Joke. Two different sources, dated April 4 and 5, both

report that Delta Airlines might be buying a currently closed

and definitely unprofitable oil refinery not far from

Philadelphia.

Why would an airline do something

like this? Some obvious answers leap to mind, but read on

below to find out the invalid aspects of such answers.

There seems no good reason at all

for Delta to enter the oil business. Which probably makes it

a sure thing that this is exactly what the airline will do.

UPDATE MAY 2012

When this article was first written in March, we were responding

only to mere rumors about Delta possibly buying this refinery.

Now, in May, the rumors have been confirmed. Delta is buying

the refinery. By all means, please still read the article

below, which can now be tested by the reality of what subsequently

happened. We stand by all we said.

Please also click on to read our subsequent

commentary and analysis on the specifics of Delta's justification

for buying the Trainer refinery.

Corporate Empire Building - Out of Fashion

Don't get me wrong. I'm all in favor of diversification;

indeed my own career and experience is a crazy example of

diversification every which way.

But note the use of the word 'crazy'. Some types of

diversification make sense, and others do not.

There was a

time when the business ethos was very much focused on building up

huge multi-national conglomerates comprising a broad mix of

diversified interests and activities - perhaps the rationale was

that doing so would spread the risk of the overall holding company

over different industries, different companies, and different

countries.

Any one company, any one industry, any one country could have

major economic problems but the conglomerate as a whole would be

only slightly affected.

(Another rationale was that businesses could borrow cheap money

and were keen to invest cheap money any which way they could.)

Those times - the 1960s and the 1970s - seem to have now been

replaced by the new business paradigm of focusing on one's core

business, and rather than growing mindlessly and without limit, of

'right sizing' a business at some ideal size (whatever that may

vaguely perceived to be). The huge multi-national

conglomerates of several decades ago have evolved and downsized

(do you remember ITT, for example?).

This occurred in the airline industry too - most notably (and most

recently) with United growing to own Hertz, Hilton and Westin, and

even renaming itself as Allegis before selling these other

businesses off and returning, suitably chastened, to its airline routes.

The airlines have of course become ardent practitioners of right

sizing. They happily cut services and reduce their schedules

any which way they can.

They're also familiar with the

concept of outsourcing aspects of their business - ranging from

code sharing flights where they don't do anything at all, to

outsourcing catering or maintenance or call centers or airport

services or just about any other part of their operation (although

they've yet to outsource their senior executives).

Delta's Proposal to Buy an Oil Refinery - Why?

So, with this as background, how can we now understand the

persuasive rumors that

Delta is looking at buying an oil refinery? See also

this

NY Times article which quotes 'a person familiar with the

deal'.

Let's look at this concept first from possible reasons why it

might be a good idea. Fuel and labor are any airline's two

biggest costs, and anything an airline can do to control or reduce

these critical cost elements surely makes sense, right?

And if the refinery can 'cut out the middle man' and simply sell

all its product to one in-house customer, that makes things much

more efficient for the refinery too, right?

Well, the first of these rhetorical questions - that controlling

costs is a good thing - is correct, but we're going to have to

think some more about whether owning one's own refinery actually

would reduce the cost of the jet fuel Delta burns. As for

the second - direct selling all one's product also seems like a

good thing, but....

How Much of the Refinery's Output Would Delta Consume?

Indeed, this second question is the easier matter to look at

first.

The thing is that when a refinery 'refines' a barrel of crude oil,

it doesn't only get jet fuel. It gets a broad mix of

different petro-chemicals, and while the refinery can slightly

alter the percentage of each different type of product it gets, it

can only modestly change the mix of products, and even then,

changing the mix of products may require massively costly capital

investments into new refining equipment.

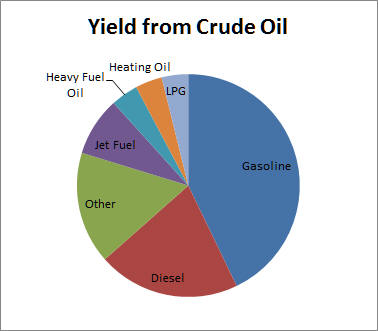

Here's a chart showing the typical mix of products created from

crude oil.

As you can see, only a very small percentage of each barrel of oil

ends up as jet fuel (about 9%), and no matter what Delta might do

if it ends up owning its own refinery, it will never be able to

substantially change this small percentage.

So the suggestion that there are any efficiencies from the

refinery perspective by having a single customer for all their

products is clearly inapplicable. Whether the concept is

true or not, the reality is that maybe Delta would take all

its jet fuel, but that leaves over 90% of the refinery's output

still needing to be sold through normal channels.

Refinery Location and Convenience for Delta

Now let's think about the next

issue. The refinery is located in Trainer, PA, which is

conveniently close to Philadelphia airport (little more than 10

miles southwest and right off I-95). It can process 185,000

barrels of oil a day, which would provide about 700,000 gallons of

jet fuel a day.

But the PHL airport isn't a

major Delta hub. Although Delta consumes about 10 million

gallons of jet fuel (worldwide) every day, it is unlikely that it could use

the full capacity of the Trainer refinery (which represents almost

7% of its worldwide consumption) for its PHL operations

only, even if every plane it flew in and out of PHL landed perilously

empty and then filled its tanks right to the top before taking off

again.

Neither are nearby airports

such as Baltimore or Newark major Delta hubs either. You

have to go all the way to JFK, 125 miles away, to find a

reasonably substantial sized Delta operation.

The best location for a

refinery, for Delta, might be somewhere close to Atlanta airport,

or one of its other major hubs, where it could readily consume all

the jet fuel produced by the refinery.

But even that isn't as simple

as it seems. Choosing a location based on convenience for

one client that would buy only 9% of the finished product makes no

sense at all. What about the other 91% of clients - and

also, what about the sources, types and costs of crude oil -

something that also varies to a great extent across the country.

Tankering Fuel to Where it Can be

Used

Which leads to the next issue.

There are regional variations in the cost of jet fuel, based on a

number of complex factors such as the availability of crude oil,

the type of crude oil, the location of refineries, and of course,

supply and demand.

Airlines manage their fuel

purchases very carefully, and will sometimes 'tanker' fuel by way

of deliberately filling a plane's tanks more than is necessary for

the next flight, so as to have some less expensive fuel in the

plane for the next journey it then makes on somewhere else.

But it isn't quite as simple

as that - an airplane burns 3%, every hour, of the weight of everything it is

carrying in the form of extra jet fuel consumed to fly that

weight, so the 'tankering' of fuel has an appreciable cost penalty associated

with it.

It may also have additional

hidden costs - flying extra fuel might limit the amount of revenue

earning cargo the flight can carry.

The best case scenario - for

Delta - would be if it was able to get such a huge cost saving

from having its own refinery as to justify tankering the fuel from

PHL and secondarily from BWI, LGA and JFK so as to be able to use

the entire jet fuel production from the Trainer refinery (okay, so

that still leaves Delta with the challenge of needing to sell the

other 91% or so of products created by the refinery, but at least

it now has the 9% of jet fuel taken care of).

Of course, even this is not as

easy as it seems. How does the jet fuel (and everything

else) get from the Trainer refinery to anywhere else? Will

Delta now have to establish a fleet of tanker trucks? Or

will it pay a third party to transport the fuel for it, and of

course, paying them an extra 'profit' amount as well.

Let's next examine a major

underlying assumption - that there's a substantial profit slice in

the selling price of jet fuel that refineries get to keep for

themselves.

Refineries Are Not Automatically

Profitable

Now for the next 'gotcha'

point. Sure, we all perceive the oil industry as making

enormous and outrageous profits, right? We read about major

oil companies making billions of dollars a year in profit, and so

it is understandable that any struggling airline would love a

chance to get a slice of these profits.

But. First, the 'oil

industry' profits are not at all outrageous when viewed as a

percentage of gross revenue or capital employed. And

secondly, the term 'oil industry' covers a lot of different

elements - exploration, drilling, distributing, refining,

marketing and retailing.

The perhaps surprising truth

is that refineries are not very profitable at all (at least in the

US). As

followers of the airline industry, we're familiar with the chronic

unprofitability of airlines, but did you know that refineries are

little better?

With the brief exception of

the period 2004 - 2008, refining has been an across-the-board

unprofitable business, which is the largest reason why there have

been no new refineries built in the US for decades.

The Trainer Refinery is So

Unprofitable it is Closed

Indeed, the refinery

that Delta is looking at buying, currently owned by

ConocoPhillips, has been closed and not working at all since last

September, apparently due to its inability to operate profitably. So too

has another nearby refinery, owned by Sunoco and located almost

immediately next to the Trainer refinery (at Marcus Hook, PA).

It seems significant that, apart from Delta, no-one else is interested in buying the refinery.

In simple terms, the problem

with the Trainer refinery is that it is set up to use the 'wrong'

sort of crude oil.

Crude oil is not a generic

product that is the same anywhere, any more than free flowing

mineral water or any other raw material is identical everywhere.

It has a different mix of components and contaminants, and has

different properties, and of course, comes from different places

with different transportation costs.

The type of crude that the

Trainer refinery was built to work with is a 'light sweet

Atlantic' type of crude, and at present that is the most expensive

type of crude oil out there.

So there is no profit that

Delta is likely to extract from the refinery. Quite the

opposite, it seems that in its past and now failed/discontinued

efforts to sell its refined products on the open market, the

refinery was generating a loss. Translation for Delta :

Every gallon of jet fuel you purchased from the Trainer refinery

in the past had a built in price subsidy - the refinery was

selling it to you for below their cost.

In such a case, why on earth

would Delta now want to buy the refinery? What possible benefit

could there be?

The Lack of Any Economy of Scale

There is another issue/problem as

well if Delta were to buy a refinery - one of 'economy of scale'.

To put this into airline

terms, imagine a startup airline, that starts with one plane, and

a requirement that this plane be based at a single, secondary

airport. Whatever the plane does during the day, it has to

be back at the home airport that night, and it can't fly more than

(say) 1000 miles away from the airport during its daily flight

operations.

If the market for this startup

airline's services grows, it can't take advantage of it, because

it only has one plane. If the market changes or shrinks, it

can't respond, because it only has one plane and one base, and it

can't swap to a smaller plane or shift the plane to another

location.

That is hardly a winning

formula for a new airline, is it.

This is analogous to what Delta would be

doing with one refinery. The major oil companies have

multiple refineries, and more refining is done off shore with

finished product being shipped to the US rather than raw crude.

But Delta would have one only refinery, in one only location.

Unlike its competitors, it would be unable to respond to regional

variations and cyclical shifts in either supply or demand.

Not a Core Competency? No

Synergy?

The key issue these days for

corporations considering adding new elements to their operation is

whether it makes use of or leverages a core competency of the

existing operation. Does the new operation reinforce and

augment the existing operation? Is there, to use a buzz

word, a 'synergy' between the current and the new business.

In the case of Delta buying a

refinery, there seems no underlying benefit at all; and about the

only shared core 'competency' is the ability to lose money -

refineries are chronically unprofitable, as are airlines too.

In other words, this would be

a ridiculous move on Delta's part.

UPDATE MAY 2012

When this article was first written in March, we were responding

only to mere rumors about Delta possibly buying this refinery.

Now, in May, the rumors have been confirmed. Delta is buying

the refinery. By all means, please still read the article

below, which can now be tested by the reality of what subsequently

happened. We stand by all we said.

Please also click on to read our subsequent

commentary and analysis on the specifics of Delta's justification

for buying the Trainer refinery.

Related Articles, etc

|

If so, please donate to keep the website free and fund the addition of more articles like this. Any help is most appreciated - simply click below to securely send a contribution through a credit card and Paypal.

|

Originally published

6 Apr 2012, last update

30 May 2021

You may freely reproduce or distribute this article for noncommercial purposes as long as you give credit to me as original writer.

|